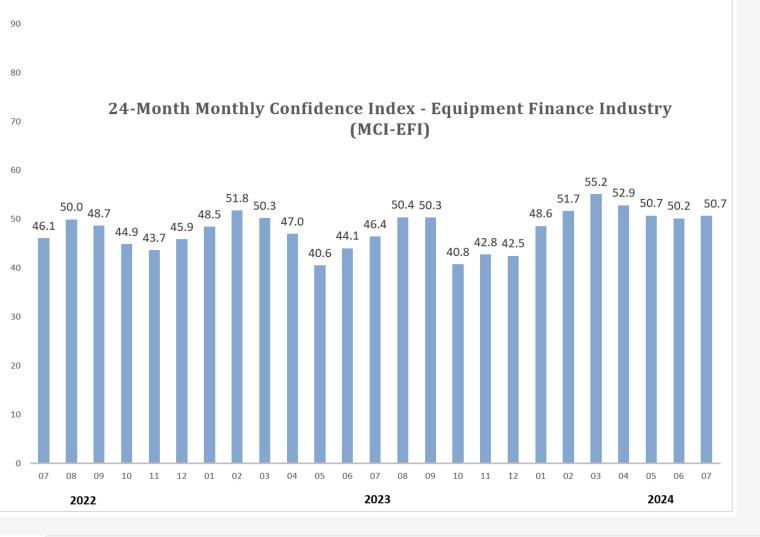

The Equipment Leasing & Finance Foundation (the Foundation) released the July 2024 Monthly Confidence Index for the Equipment Finance Industry (MCI-EFI) last week. Overall, confidence in the equipment finance market is 50.7, steady with the May and June MCIs of 50.7 and 50.2, respectively. The index reports a qualitative assessment of both the prevailing business conditions and expectations for the future as reported by key executives from the $1 trillion equipment finance sector.

When asked about the outlook for the future, MCI-EFI survey respondent Lyndon Thompson, President, Byline Financial Group, said, “Companies are falling behind on capex, but the need for replacement is necessary, despite rising costs and increased financing expenses. Upgrades are essential for growth and to stay competitive, though it’s unlikely costs will decrease in the foreseeable future.”

July 2024 Survey Results:

The overall MCI-EFI is 50.7, steady with the June index of 50.2.

- When asked to assess their business conditions over the next four months, 3.9% of the executives responding said they believe business conditions will improve over the next four months, a decrease from 11.5% in June. 76.9% believe business conditions will remain the same over the next four months, unchanged from the previous month. 19.2% believe business conditions will worsen, up from 11.5% in June.

- 11.5% of the survey respondents believe demand for leases and loans to fund capital expenditures (capex) will increase over the next four months, up from 7.4% in June. 73.1% believe demand will “remain the same” during the same four-month time period, down from 77.8% the previous month. 15.4% believe demand will decline, a slight increase from 14.8% in June.

- 19.2% of the respondents expect more access to capital to fund equipment acquisitions over the next four months, unchanged from June. 76.9% of executives indicate they expect the “same” access to capital to fund business, up from 73.1% last month. 3.9% expect “less” access to capital, down from 7.7% the previous month.

- When asked, 23.1% of the executives report they expect to hire more employees over the next four months, a decrease from 25.9% in June. 69.2% expect no change in headcount over the next four months, up from 66.6% last month. 7.7% expect to hire fewer employees, relatively unchanged from June.

- None of the leadership evaluate the current U.S. economy as “excellent,” down from 3.9% the previous month. 84.6% of the leadership evaluate the current U.S. economy as “fair,” up from 76.9% in June. 15.4% evaluate it as “poor,” down from 19.2% last month.

- 19.2% of the survey respondents believe that U.S. economic conditions will get “better” over the next six months, up from 14.8% in June. 57.7% indicate they believe the U.S. economy will “stay the same” over the next six months, an increase from 48.2% last month. 23.1% believe economic conditions in the U.S. will worsen over the next six months, a decrease from 37% the previous month.

- In July, 19.2% of respondents indicate they believe their company will increase spending on business development activities during the next six months, an increase from 14.8% the previous month. 73.1% believe there will be “no change” in business development spending, down from 77.8% in June. 7.7% believe there will be a decrease in spending, relatively unchanged from last month.

There are no comments

Please login to post comments