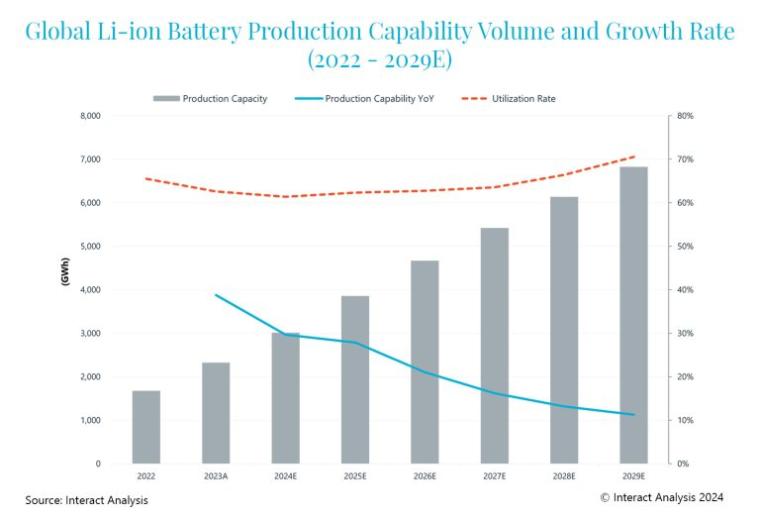

Over the last few years – particularly in 2021 – the battery manufacturing equipment market witnessed a huge expansion in production capacity, according to new research from Interact Analysis. From 2021 to 2023, global li-ion battery capacity climbed to a total of 2.3 TWh and is expected to reach a grand total of 6.8 TWh by 2029. However, as the boom in production capacity begins to slow down, there is currently a record-low utilization rate of 61.4%.

Despite a somewhat pessimistic forecast for market revenue, demand from all regions continues to drive the battery equipment market.

In 2023, the Asia-Pacific region maintained an 88.6% share of the battery manufacturing equipment market and amassed $18 billion in value – a feat achieved because of China’s huge production base (making up 89.2% of total global production). China is still expected to account for 75% of global market revenues, despite a downward trend in production capacity expansion. EMEA was valued at $1 billion in 2023 and is predicted to experience the fastest growth rate between 2024 and 2029, with a 5-year compound annual growth rate (CAGR) of 20.4% taking revenues to $3.6 billion. Similarly, the Americas region was also valued at $1 billion in 2023 and is expected to witness a 5-year CAGR of 19.7%, growing to $3.9 billion by 2029.

Li-ion battery shipment rates are expected to remain positive over the forecast period, having surged by 38.8% year-on-year in 2023 to reach a new high of 1,100 GWh. In 2024, total shipments are estimated to grow by 21.2% year-on-year to 1,334 GWh, driven by robust demand in the energy storage market. Furthermore, this growth momentum will continue in the future, with the sector registering a 21.4% CAGR from 2024 to 2029, rising to 3,515 GWh in 2029.

Finally, the global market for Li-ion battery equipment was valued at $20.3 billion in 2023, following year-on-year growth of 32% from 2022. It is forecast to generate a 5-year global CAGR of 7.1% from 2024 to 2029 to reach $30 billion.

The graph demonstrates the increase in global production capacity from 2022 to 2029, while the year-on-year production capability decreases.

Korean and Japanese equipment vendors to benefit from future capacity expansion

Capacity expansion in recent years ramped up demand for battery equipment. This facilitated the entry of a growing number of equipment vendors into the market and, overall, intensified market competition. The competitive landscape of the battery equipment market is fragmented, with the top suppliers (all of which are Asian) accounting for less than 30%.

Set to benefit from future capacity expansion are South Korean and Japanese equipment vendors. However, Chinese vendors will maintain their dominance both globally and specifically within the Asia-Pacific region, with nine out of ten of the largest global suppliers currently being Chinese.

Maya Xiao, Research Manager at Interact Analysis, states, “The market is recovering from overcapacity and an underutilized battery manufacturing infrastructure due to the steepness of capacity expansion over the last few years. This has necessitated the current slowdown in capacity expansion which, while corrective, may have a negative impact on market revenue.”

About the Report:

This report provides a deep-dive analysis of the li-ion battery supply chain, comprising:

• Granular data analysis of Li-ion battery production and shipments, the end-user market landscape, supplier market shares and a highly-detailed factory database.

• In-depth analysis of the lithium-ion battery manufacturing equipment market in different regions, as well as the equipment supplier landscape.

New for 2024 – the report is available in both a standard and premium version. The premium version offers greater detail on market statistics, as well as a quarterly analyst briefing.

About Interact Analysis

With over 200 years of combined experience, Interact Analysis is the market intelligence authority for global supply chain automation. Our research covers the entire automation value chain – from the technology used to automate factory production, through inventory storage and distribution channels, to the transportation of the finished goods. The world’s leading companies trust us to surface robust insights and opportunities for technology-driven growth. To learn more, visit www.InteractAnalysis.com

There are no comments

Please login to post comments