That is not to say it’s difficult to find communities that want to become home to the next Google or Amazon. To the contrary, the tech sector has become synonymous with progress in America, and it is often regarded as the Holy Trinity of economic development, i.e., high-profile, high-paying and high-productivity.

When it comes down to it, though, the tech sector can be defined by one word: disruption. Success in the industry often means shaking up the economic, political and social landscape. It is precisely this environment of rapid and wide-sweeping change that makes site selection for tech companies such a complex business. Not only do professionals need to keep their finger on the pulse of current conditions, but they must also be able to anticipate how future shifts will impact their clients’ bottom line.

Setting these complications aside, however, and finding a new home for a tech company is not wholly different from that of other industries. The overall process shares many similarities, and the first step in that process is always going to be an evaluation of brand. The simple fact is that there are far too many possible options, both domestically and abroad, for every community to be given consideration. Instead, site selectors look for communities with a strong established tech brand to narrow the initial list down to anywhere from 10 to 20 cities. So what is a city’s brand, exactly?

When considering this broader scope of brand, a whole host of qualities is taken into account. Is there a sufficient population of young, working professionals to build out an effective workforce? Are those professionals sufficiently well-educated and trained? Is the entrepreneurial climate such that it will attract new labor? Does the community possess that quality of place, that hipster je ne sais quoi to retain that young, well-educated work force? In this way, branding becomes a holistic personification of the beating heart that makes a city what it is. It therefore bears remembering that many of the United States’ tech capitals are known for a lot more than their tech-driven economies. Boston is a city renowned for its rich history and culture, Austin is the “Live Music Capital of the World” and San Francisco is perhaps the most diverse, tolerant and bohemian city in the Western Hemisphere. The bottom line? Brand is important.

Once cities have been sifted through the somewhat ethereal but all-important brand filter to come up with a short list of three to five potential cities, the process becomes much more systematic, mathematic and almost mechanical. This is the stage in the process where those hundreds of variables come in with a vengeance. Supply chains, local competitors, labor costs, utilities, logistics infrastructure, incentives programs; all of these considerations — and many, many more — factor into what is essentially a giant economic optimization equation.

At this point, though, it seems worthwhile to take a step back and point out that tech is not some giant, monolithic entity with uniform wants and needs. It is amalgamation of dozens of fields and sub-sectors, each with their own scopes, aims and business models. Likewise, what companies look for in a site vary considerably across the tech world; a two-man app startup has different needs than a medical implant manufacturer, which in turn has different needs than a 500,000-square-foot data center. Understanding these different requirements and how they factor into that optimization equation is therefore essential for success when it comes to site location for the tech sector.

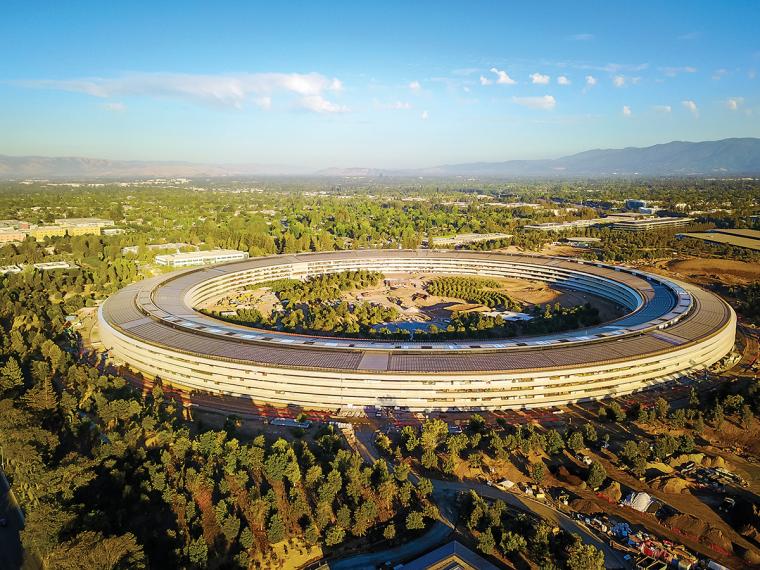

For some tech endeavors, such as software development, location decisions are heavily influenced by pre-existing clusters. This is evidenced clearly by how software development operations are limited to a relatively small number of regions nationwide. A quick survey of top industry clusters is almost boringly predictable: Silicon Valley, Seattle and Boston lead the way with small but still substantial clusters present in locales such as Austin, Utah’s Silicon Slopes and North Carolina’s Research Triangle.

For some tech endeavors, such as software development, location decisions are heavily influenced by pre-existing clusters. This is evidenced clearly by how software development operations are limited to a relatively small number of regions nationwide. A quick survey of top industry clusters is almost boringly predictable: Silicon Valley, Seattle and Boston lead the way with small but still substantial clusters present in locales such as Austin, Utah’s Silicon Slopes and North Carolina’s Research Triangle.

There is nothing in the water that makes these regions inherently favorable to software development. What they do have are a number of prominent employers that attract a large and highly skilled workforce, which further attracts more prominent employers looking to expand, and so on and so on in a powerful feedback loop.

Likewise, for young entrepreneurs looking to score it big with the next breakout app, these regions provide a number a major draws. Local accelerators have a proven track record of success (think of Y Combinator), the networking and mentorship opportunities are second to none, and to put it eloquently, the venture capital funding doth floweth. Over the past four quarters, nearly 70 percent of the approximately $2.6 billion has gone to three regions, the Bay Area, Boston and Texas – primarily Austin.

So, yes, the viable site location options for new or expanding software companies may be limited, but that doesn’t mean there are no options. Though Silicon Valley might still reign as king — and likely will for years to come — operating can politely be described as “pricey,” especially when compared against other prominent competitor regions. It was precisely these cost considerations, as well as access to a talented labor pool, that drove mid-size software development firm Serenova to relocate from San Francisco to Austin in late 2015.

But what about the subset of technology that is less about the software and more concerned about the hardware side of things? Advanced manufacturing is one of the most talked-about elements of the modern American economy, primarily because it blends high technology with the rugged blue-collar work ethic that characterized what many consider to be America’s economic golden age.

But what about the subset of technology that is less about the software and more concerned about the hardware side of things? Advanced manufacturing is one of the most talked-about elements of the modern American economy, primarily because it blends high technology with the rugged blue-collar work ethic that characterized what many consider to be America’s economic golden age.

While the importance of R&D in advanced manufacturing certainly shouldn’t be written off entirely, when it comes to actually making things, a whole different set of factors come in to play: access to affordable labor, robust logistical networks and ample space for manufacturing plants are but a few of the many site location considerations of these companies. Not surprisingly, the Midwest continues to meet these needs and thus continues to play a defining role in advanced manufacturing. Land and labor remain considerably cheaper in the flyover states than on the coasts, and with its numerous world-class freight airports and location at the center of the nation’s rail network, the Midwest also satisfies many of the logistical requirements of the industry.

Consequently, many Midwestern cities have grown to or continue to dominate high-tech manufacturing. Indianapolis and Northern Indiana are the greatest producers of medical devices, while Wisconsin and the Twin Cities are key hubs for the manufacturing of precise industrial equipment. This is unlikely to change any time soon, either. For example, when discussing a decision to expand into Minnesota, manufacturing firm Cirtec specifically cited the region’s strong workforce and other logistical support for the industry as the reason behind its decision. Advanced manufacturing thus has the potential to inject much-needed economic diversity into a swatch of the country largely overlooked by the broader tech sector for years to come.

Naturally, the cost of electricity is not the only factor influencing where companies decide to build their data centers. Telecomm infrastructure, access to labor and the likelihood of natural disasters all play significant roles as well. But even within the narrow scope of utility costs, company motivations often aren’t as crude as finding the cheapest kilowatt hour. The growing trend within the industry is not just to find cheap energy, but to find cheap, renewable energy. This heavy emphasis on environmental friendliness has even led to such out-of-the-box solutions as building a data center in an abandoned Norwegian mine.

And that really gets down to the heart of the issue: site location for tech companies is a complex, niche affair that often requires true innovation. The three examples above were chosen to highlight the myriad needs and considerations of companies under the tech umbrella, but they by no means encompass the entire sector. Successful site location therefore must begin with an understanding of the unique needs of the slice of the tech sector in question. Anything less runs the risk of forcing a USB-C shaped peg into a lightning charger shaped hole. T&ID