As the federal government makes big bets on advanced technology with a new national industrial policy designed to cement the United States’ position as a global leader in innovation, many states have chosen to take the lead by building academic and commercial hubs that encourage research organizations and technology companies to work together to advance industries such as clean technology, quantum computing and semiconductors. Colorado is doing just that.

A Collaborative Ecosystem Fostering Advanced Technologies

“For some time, there have been two things that have driven investment and advanced industry clustering in Colorado,” said Dan Salvetti, Colorado’s Semiconductor Industry Manager, of the Office of Development and International Trade (OEDIT). “These elements are an available talent pool of workers trained in advanced technology as well as a premiere research and development ecosystem that includes several research universities, like the University of Colorado, Colorado State University and Colorado School of Mines along with dozens of national labs, like NIST’s Boulder Lab, DOE’s Natural Renewable Energy Lab, the CDC’s Vector Borne Disease Division, NOAA’s Earth Systems Lab and more.”

Colorado’s innovation comes from the collaboration of these different federal labs and universities with technology companies to share breakthroughs, apply new knowledge to high-tech processes and ensure that the next-generation workforce is trained and available to fill jobs.

Such an ecosystem has helped the state produce and attract talent with dramatic results. Colorado is second in the U.S. for the share of adults with a bachelor’s degree or higher, exceeding 40 percent. It is also fifth in the share of employment in STEM (science, technology, engineering and mathematics) occupations at nearly 10 percent and third in labor force participation at nearly 70 percent.

Colorado Advanced Industries are Growing, in Strength and Notoriety

In October 2024, a report published by commercial real estate firm CBRE ranked Colorado Springs the number two up-and-coming market for tech talent in North America. The report found that more than 20,000 tech workers were employed in Colorado Springs in 2023 in semiconductor manufacturing, aerospace and other high-tech industries including clean tech and quantum computing. This represents a 12 percent increase over the previous five years. In the same period, wages grew by 20 percent, with the average salary nearing $117,000.

Growth and innovation aren’t limited to Colorado Springs, however. A high-tech zone in Colorado includes the entirety of the region known as “the Front Range,” which extends along the foothills of the Rocky Mountains from Fort Collins in the north; through Longmont, Boulder and Denver; and down to Colorado Springs in the south. Organizations working in aerospace, semiconductors, quantum, photonics, cleantech and information technology are plentiful and on the rise throughout the region.

Communities outside of this area are seeing these industries take hold as well. Some notable examples include a bio-ceramics production facility in Grand Junction, a 368-turbine wind farm in Limon and 3D printed homes in Buena Vista, just to name a few. Colorado is a growing, tech-savvy state.

Semiconductors in Colorado

Colorado’s semiconductor industry is substantial and growing. It is ninth in the U.S. for the number of semiconductor facilities and third in facilities dedicated to design and R&D. There are nearly 7,000 Coloradans employed in the industry, with the number set to rise with recent expansion projects.

Importantly, the whole value chain is present in the state. There are two major fabrication facilities owned by Broadcom in Fort Collins and Microchip in Colorado Springs. Colorado is also home to InnovaFlex, a foundry that prints semiconductor devices on glass and flexible substrates. It is the only facility of its kind outside of Asia.

Some of the largest integrated device manufacturers and fabless companies in the world – Intel, Micron, AMD, Qualcomm, NVIDIA, Analog Devices and Western Digital – have substantial design and R&D operations within the state. Local materials and equipment providers include Entegris, Forge Nano, CoorsTek and HighVac Corporation. Even packaging and test operations are present with companies like Semtech and FormFactor.

Like advanced industries in general, these companies work together with universities and labs, such as the University of Colorado, Colorado Springs’ Microelectronics Research Lab and Colorado State University’s Advanced Beam Lab.

Energized by Federal Investments

The CHIPS and Science Act is a federal statute enacted by the 117th Congress in 2022 and the most recent legislation defining current U.S. national industrial policy, along with the Infrastructure Investment and Jobs Act and the Inflation Reduction Act. The Act established a broad set of initiatives to substantially increase scientific research and commercialization throughout the nation, including direct funding for semiconductor companies to expand and launch operations on American soil. Colorado has positioned itself to take advantage of the legislation.

Earlier this year, Arizona-based Microchip received $90 million in federal funding under the Act for a major expansion of its Fab 5 facility in Colorado Springs. The company was the second organization to sign an agreement with the CHIPS Program Office, the federal office charged with distributing the funding. Microchip currently employs nearly 1,000 workers in Colorado. The expansion will add nearly 400 more and invest almost $900 million in additional capital.

Several months later, Entegris, a Massachusetts-based supplier of materials handling solutions for advanced industries including semiconductors, was awarded $75 million from the CHIPS Act to support the construction of a new state-of-the-art, $600 million manufacturing center of excellence in Colorado Springs. The project is expected to create 600 new jobs and will produce vital components for fabs owned by the likes of TSMC, Intel and Samsung.

Colorado is one of only eight states that have seen multiple awards from this program.

“We are a leader in the semiconductor industry,” explained Salvetti. “Colorado has a robust local ecosystem that spans the semiconductor value chain from design to test. We appreciate the federal government’s recognition and support of our innovative companies and look forward to a long, fruitful partnership.”

The State of Colorado supported both projects with incentives, including a newly established program to help draw in these federal investments.

Colorado Becomes a Leader in Semiconductor Metrology

A critical aspect of semiconductor industry growth is metrology, or the scientific study of measurement. As devices become smaller and more complex, the ability to measure, monitor, predict and ensure quality in manufacturing is crucial. The CHIPS Metrology Program, another initiative from the CHIPS Act, was created to emphasize measurements that are accurate, precise and fit-for-purpose for the production of microelectronic devices.

The CHIPS Metrology Program is administered by the National Institute of Standards and Technology (NIST), which establishes the measurement standards for semiconductors and other types of advanced manufacturing. Not long after the CHIPS Act was made law, NIST determined that it would base the program at its Boulder Labs in Colorado, co-located with its Microfabrication Facility and Communication Technology Facility. The program has a budget of $1.75 billion.

In September 2024, the CHIPS Metrology Program announced 17 grant recipients of its Small Business Innovation Research (SBIR), which it had launched in April. Companies in Colorado accounted for three of these awardees. Only one other state received multiple awards. Each of the Colorado companies received about $300,000 to support the development of innovative semiconductor metrology technologies.

An Innovation Engine, an Innovation Hub

In addition to direct funding to semiconductor companies and the CHIPS Metrology Program, Colorado has successfully earned designations under other national funding competitions.

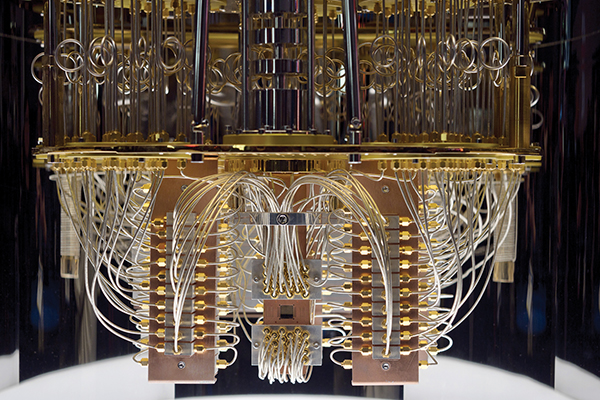

“The CHIPS Act also included the National Science Foundation’s Regional Innovation Engines and the Economic Development Agency’s Regional Innovation Hub programs, better known as the Engines and Tech Hubs” noted Salvetti. “Colorado consortia were successful in securing designations under each of these competitions. For the engines, we have the Colorado-Wyoming Climate Resilience Engine, dedicated to developing innovative solutions in climate technology. For the tech hubs, we have Elevate Quantum, focused on the commercialization of quantum technologies. These were also examples of our willingness to collaborate across borders, with Wyoming and New Mexico our partners in these programs.”

The Colorado-Wyoming Climate Resilience Engine is one of 10 in the U.S. It will receive up to $15 million from the National Science Foundation (NSF) for the first two years, with the potential to receive an additional $160 million over 10 years. Elevate Quantum is one of 12 Tech Hubs and the only one focused on quantum technologies, cementing Colorado’s place as a global leader in this world-changing industry. The designation brought with it $40.5 million in funding from the Economic Development Agency (EDA), which in turn unlocked $84 million in state support and $1 billion in private capital.

A Dedicated State Partner Through It All

“For these advanced industries, the state government is nothing more than a catalyst,” said Salvetti. “Our companies, our labs, our universities and our talented people are the ones driving change daily. We are just here to give an extra boost.”

This “extra boost” comes in many forms, noted Salvetti, including funding, technical assistance, collaboration and networking, information sharing and leadership.

“Of course, we supported the Microchip and Entegris projects — along with a few other semiconductor expansions and modernizations — with state funding tools,” said Salvetti. “But we are working to take a much more holistic approach. We’ve worked to address workforce development by launching new programs, like our $85 million Opportunity Now grants. We’ve worked with our sister agencies like the Colorado Department of Labor and Employment and the Colorado Department of Public Health and Environment to develop solutions to non-financial barriers to business within the state. We’ve signed on as board members and advisors for the Colorado-Wyoming Climate Resilience Engine and Elevate Quantum. And we’ve organized our stakeholders to pursue additional federal opportunities, like the programs of the National Semiconductor Technology Center and the EDA Good Jobs Challenge.” said Salvetti.

He further noted that this is but a fraction of the state’s efforts to advance these industries. OEDIT routinely brings Colorado companies to trade shows, runs trade and investment missions to international markets and hosts networking events locally. In 2024 alone, these efforts included the Colorado Semiconductor Workforce and Innovation Forum co-hosted by CU Boulder, a Colorado-sponsored booth at SEMICON Taiwan with three co-exhibiting companies and an investment mission to Taiwan and Korea led by Lieutenant Governor Primavera and attended by a 16-person delegation of company executives and local government leaders.

Traditional State Incentives Help Advanced Technologies Flourish

The State of Colorado offers a number of state incentives designed to complement federal incentives. These include:

The Job Growth Incentive Tax Credit. This is an eight-year job creation incentive to support competitive, multi-state or country relocation and expansion projects. The credit gives businesses a Colorado state income tax credit equal to 50 percent of the FICA tax paid by the business per net new job for each calendar year.

Strategic Fund Job Growth Incentive. The Strategic Fund Job Growth Incentive is for expansion or relocation projects for which Colorado is in competition with at least one other state, and for which the company has received a commitment of local government funding that matches any requested state government incentives. The incentive provides a cash payment over five years to companies that create and maintain new permanent jobs in Colorado.

Enterprise Zone program. The Colorado legislature created the EZ Program to encourage development in economically distressed areas. The 16 designated enterprise zones have high unemployment rates, low per capita income or slow population growth.

New Semiconductor Programs Launched by the State

In 2023, the state launched the Colorado CHIPS Zones and the Colorado CHIPS Refundable Tax Credits. Regions in Colorado can now be designated as Colorado CHIPS zones to maximize incentives available to eligible semiconductor companies. In addition, the Colorado Chips Refundable Program allows companies to trade in earned credits through either the jobs growth incentive tax credits or the enterprise. Essentially, companies can approach the department of revenue and trade their credits in at 80 percent of the value.

For more information about the advanced manufacturing

opportunities offered by Colorado, visit https://oedit.colorado.gov . T&ID

There are no comments

Please login to post comments