Image via Wikipedia

Rivera Consulting Group Inc., a technical services firm specializing in U.S. Department of Defense software applications, announced today that it will expand its operations and construct a new headquarters here, creating up to 85 new high-wage jobs by 2015.

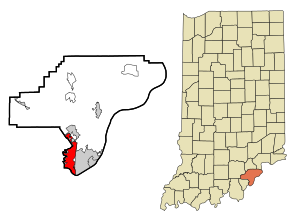

Founded in 2002, Rivera Group is a veteran-owned, information technology company that provides software development services, defense-related applications and enterprise system consulting to private sector companies and government agencies. It plans to invest $5.6 million to construct and furnish a 25,000-square-foot facility to house new and existing operations in Clarksville. The new facility will enhance the company's capabilities, enabling them to increase their support of both private and federal sector contracts.

"Indiana has a well-deserved reputation as a state where high-tech companies can succeed," said Governor Mitch Daniels. "We're excited about the technology that Rivera Group is developing and are proud that Hoosiers will contribute to the important work of protecting the brave men and women of our armed forces."

Rivera Group, which was recognized as a 2011 "Company to Watch" recipient in July, plans ongoing hiring of information technology professionals. The highly-skilled positions will earn an average salary of $85,000. Interested candidates should apply at www.riverainc.com.

"We are very excited about building our corporate headquarters in southern Indiana. The talent pool from the state of Indiana is second to none and the future at Rivera Group couldn't be any brighter," said Dr. Joey Rivera, president of Rivera Group. "We are also pleased with the support we have received from One Southern Indiana, the town of Clarksville and the state of Indiana."

The Indiana Economic Development Corporation offered Rivera Consulting Group, Inc. up to $1.1 million in conditional tax credits based on the company's job creation plans. These tax credits are performance-based, meaning until Hoosiers are hired, the company is not eligible to claim incentives.The town of Clarksville will consider additional financial support for the project at the request of One Southern Indiana.

"Rivera Group's expansion is a welcome addition to Clarksville's economic base," said Greg Isgrigg, town council president.

According to a report recently released by the Indiana Business Research Center at Indiana University's Kelley School of Business, more than 1,100 Hoosier companies were successful in attracting $4.4 billion in contracts from the U.S. Department of Defense and Homeland Security in 2010, supporting an estimated 38,600 Indiana jobs. Just last August, Next Wave Systems, a defense technology and engineering firm, announced plans to expand its operations in Bloomington, creating up to 60 new jobs by 2014. The company supports the U.S. Department of Defense, including operations at the Naval Surface Warfare Center at Crane.

About Rivera Group

Rivera Consulting Group, Inc. is a Veteran-Owned Small Business that specializes in Department of Defense software solutions. Rivera Group has three specialized software products that accompany their consulting services, and have contracts in multiple government agencies ranging from the U.S. Customs and Border Patrol to the Department of the Army. The company is owned by Dr. Joey Rivera, who is a Veteran of the U.S. Army. To learn more, please visit www.riverainc.com.

About IEDC

Created by Governor Mitch Daniels in 2005 to replace the former Department of Commerce, the Indiana Economic Development Corporation is governed by a 12-member board chaired by Governor Daniels. Dan Hasler serves as the chief executive officer of the IEDC. The IEDC oversees programs enacted by the General Assembly including tax credits, workforce training grants and public infrastructure assistance. All tax credits are performance-based. Therefore, companies must first invest in Indiana through job creation or capital investment before incentives are paid. A company who does not meet its full projections only receives a percentage of the incentives proportional to its actual investment. For more information about IEDC, visit www.iedc.in.gov.